(Bloomberg) -- Growing investor angst about China’s real estate crackdown rippled through markets on Monday, pummeling Hong Kong developers and adding pressure on Beijing authorities to stop financial contagion from destabilizing the economy.

Hong Kong real estate giants including Henderson Land Development Co. suffered the biggest selloff in more than a year on speculation China will extend its property clampdown to the financial hub. Fears of contagion from China Evergrande Group continued to intensify, dragging down everything from bank stocks to Ping An Insurance Group Co. and high-yield dollar bonds.

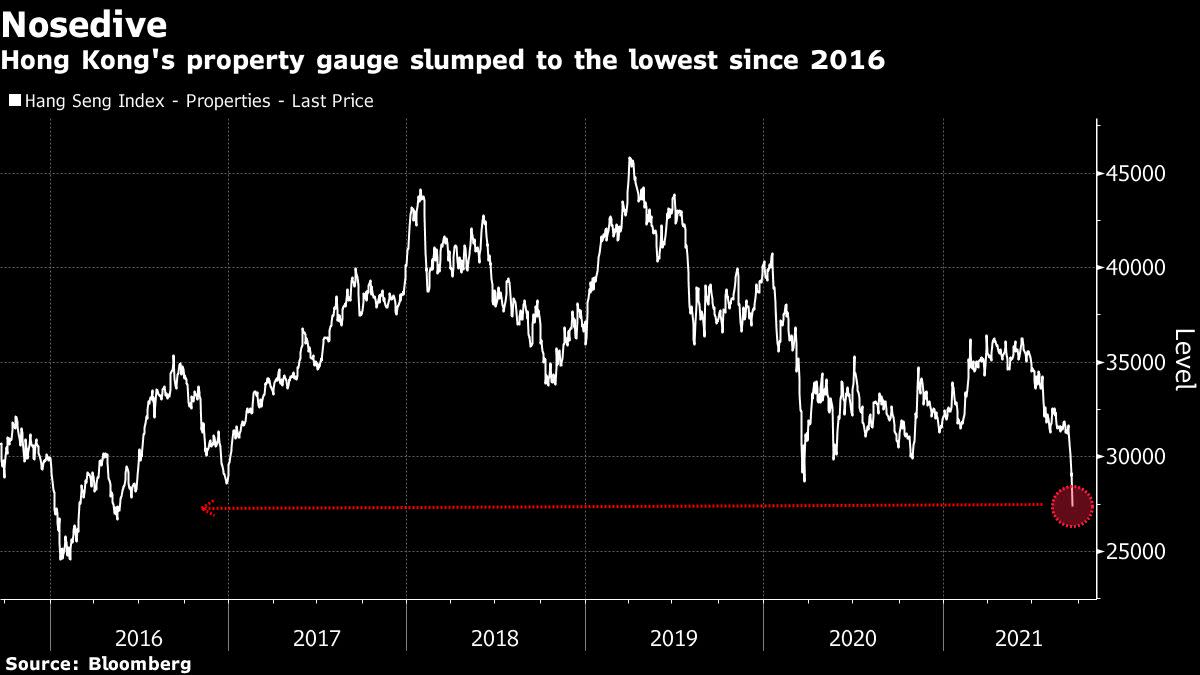

The Hang Seng Index dropped 3.9% at the midday break, its biggest loss since late July. The selling spilled over into the Hong Kong dollar, offshore yuan and S&P 500 Index futures. Holiday closures in much of Asia may have exacerbated the volatility, traders said.

Faced with uncertainty over how much economic fallout President Xi Jinping is willing to accept as he pushes forward with market-roiling campaigns to achieve “Common Prosperity” and rein in overindebted companies, many investors are choosing to sell first and ask questions later. Interest payment deadlines this week on several Evergrande bonds and bank loans add another layer of risk as market participants brace for what could be one of China’s largest-ever debt restructurings.

“The price action across several asset classes in Asia today is horrendous due to rising fears over Evergrande and a few other issues, but it could be an overreaction due to all of the market closures in the region,” said Brian Quartarolo, portfolio manager at Pilgrim Partners Asia.

The Hang Seng Property Index tumbled 6.6%, the most since May 2020. Henderson Land dropped 12%. Sun Hung Kai Properties Ltd. slumped 9.1%, poised for its biggest loss since 2016. CK Asset Holdings Ltd. sank 7.9%.

Chinese officials told Hong Kong developers that Beijing is no longer willing to tolerate what it calls monopoly behavior, Reuters reported Friday. The officials didn’t lay out a roadmap or a deadline, the report said, citing unidentified developers.

“This is a paradigm shift,” said Hao Hong, chief strategist at Bocom International, referring to the Reuters report. “People need to keep a close look.”

Hong Kong’s government has long struggled to bring home prices under control amid outsized demand, limited supply and low borrowing costs. Hong Kong’s average property value was a world-beating $1.25 million as of June 2020, according to CBRE Group Inc.

Risk-off sentiment in financial markets was widespread on Monday. Junk-rated Chinese dollar bonds slid by as much as 2 cents. The Hong Kong dollar fell to the lowest level this month. The offshore yuan declined for a third day. FTSE China A50 Index futures slid 3.9%. Mainland financial markets are closed for public holidays until Wednesday, when Hong Kong will be shut. S&P 500 Index futures dropped 0.9%.

“We are seeing fears of contagion from China Evergrande playing out,” said Jun Rong Yeap, market strategist at IG Asia Pte.

Evergrande is scheduled to pay interest on bank loans Monday, with a one-day grace period. While details on the amount due aren’t publicly available, Chinese authorities have already told major lenders not to expect repayment, people familiar with matter said last week. Evergrande and banks are discussing the possibility of extensions and rolling over some loans, the people said.

The developer’s stock sank as much as 19% Monday, on track to close at its lowest-ever market value.

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.

Article From & Read More ( Hong Kong Stocks Sink as Property Fear Spreads Beyond Evergrande - Yahoo Finance )https://ift.tt/3CpndSX

Business

Bagikan Berita Ini

0 Response to "Hong Kong Stocks Sink as Property Fear Spreads Beyond Evergrande - Yahoo Finance"

Post a Comment